Sales Tax Maintenance

Module: Company Data

Module: Company DataPath: Company > Company > Sales Tax Maintenance

Topic: Sales Tax Maintenance

Version(s): Version 5.1 and up

Editions: All Editions

What Are Sales Tax

Sales Tax is the percentage of tax added to an order depending on where the order is shipping to. Some times there is state, county, and city tax that is required to be collected in addition to the price of the items being sold.

Making The Connection

Where Will I See This Within OLX?

Script

Once Sales Tax has been setup you must navigate to each script that will add tax to orders created. Selecting the Region/Taxes tab will bring you to location criteria of which orders must apply tax to the products based on shipping address. You will also select which Tax Provider Account the taxed locations will use (one per script).

Imported Orders

Once you have setup Sales Tax and added location criteria to the script your imported orders must provide the tax values during order import.

<PRODUCT01>C.S Test Product 30</PRODUCT01>

<DESCRIPTION01>Test Product</DESCRIPTION01>

<QUANTITY01>2</QUANTITY01>

<PRICE01>15.00</PRICE01>

<DISCOUNT01>0</DISCOUNT01>

<COUPON_CODE01></COUPON_CODE01>

<SHIPPING01>1.00</SHIPPING01>

<TAX_RATE01>6.5</TAX_RATE01>

<TAX_PROD01>0.975</TAX_PROD01>

<TAX_SHIPPING_PROD01>0.65</TAX_SHIPPING_PROD01>

<PAID_PRICE_PROD01>30.00</PAID_PRICE_PROD01>

<PAID_SHIPPING_PROD01>1.00</PAID_SHIPPING_PROD01>

<PAID_TAX_PROD01>2.60</PAID_TAX_PROD01>

Order Entry Screen

When entering an order, after the shipping address is filled in and product selected you will notice the Tax field populate if the location criteria has been selected on the Script being used.

Order Detail Screen

After an order has been entered (manually or via import) and you navigate to the Order Detail screen you will see the Tax values on each corresponding item line.

What Reports Can Be Pulled?

- Sales Tax By State

- Sales Tax

- Sales Tax By State/Order

What Imports/Exports Relate to xxxx

- Order Imports

Trouble Shooting

There is no sales tax on the order

- Confirm the location is selected on the script associated to the order in question

When entering an order manually the tax is not populating

- Confirm there is a shipping address associated to the order

Setup

Navigate to the Sales Tax Maintenance module from the Company Data menu. (Company Data > Company > Sales Tax Maintenance)

Tool Bar

Utilizing the buttons on the tool bar  you can:

you can:

Go back to the previous screen

Print

Minimize module

Filter

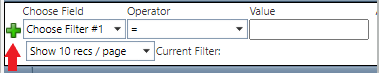

You can use the filter options to narrow down the displayed selections.

Add additional filters by click the Add button

Apply the filtered selections by clicking Apply Filter

Remove the filtered selections by clicking Remove Filter

You can set the number of records to be displayed

Copy/Edit

- To copy an existing record, click on the copy button next to the record you want to copy.

- To edit an existing record, click on the edit pencil next to the record you wish to edit.

Sales Tax is always based on Shipping Address

- Enter the 1st percentage into the Rate 1 field for the this specific client tax override.

- If there is a 2nd rate applicable for this state override, then enter the value in the Rate 2 field.

- Check off the box, If the shipping amount for the order should be taxable.

Add County Tax

- Click on Add new record

- Select the County from the drop down

- Set Rate 1

- Set Rate 2

- Check if Shipping Tax will also apply for the County in addition to the State

- Save the record

- Repeat as needed until all necessary Counties have been added.

Add City Tax

- Click on Add new record

- Select the City from the drop down

- Set Rate 1

- Set Rate 2

- Check if Shipping Tax will also apply for the City in addition to the State

- Save the record

- Repeat as needed until all necessary Counties have been added.

* To save the changes click the Save button  .

.

* To cancel any of the current changes you have made click the Cancel button  .

.

This will close the window without saving any changes.

* To print the current window click the Print button  .

.

* To delete the selection click the Delete button  .

.

This will prompt you to make sure you want to delete this item.

- Clicking OK will delete the selected item and close the window.

Sales Tax Maintenance

Copyright 2019

Revised 5.7.2019

Related Articles

5.1.41 - Sale Tax Maintenance

Version: 5.1 Patch: 041 Title: Sale Tax Maintenance Application Category: Other Patch Type: Feature Description: Made few appropriate changes to Sale Tax Maintenance screen to make it compatible with new table named ""tblTax"". Based rates for States ...Tax Table

Module: Tax Tables Path: Campaigns > Payment Data > Tax Tables Topic: Tax Tables Version(s): 5.1 and up Editions: All What Are Tax Tables Previously the Sales Tax Maintenance held all of the tax information from the OLX internal tax system. We have ...5.1.2 - Improved Tax Calculation

Version: 5.1 Patch: 002 Title: Improved Tax Calculation Application Category: Other Patch Type: Feature Description: Tax calculation in OLX is now based on a more detailed tax table. Rates in some complex tax regions, such as Schenectady NY will be ...R21 p62 - Set default tax provider to service based Tax provider V2

Version: 5.1 Release Number: 21 Patch: 62 Title: Set default tax provider to service based Tax provider V2 Application Category: Other, Order Entry Patch Type: Feature Description: Made tax provider V2 (service based) the application default. Hid the ...R20.5 p16 - New Tax Service For Improved Accuracy

Version: 5.1 Release Number: 20.5 Patch: 16 Title: New Tax Service For Improved Accuracy Application Category: Other, Order Entry, CS Functionality (1) Patch Type: Feature Description: Implemented a new tax service for OLX. Service will provide more ...