Sales Tax Report Definitions

Module: Reports

Path: Reports > Sales Reports > Sales Tax Report

Topic: Sales Tax Report

Version(s): 5.1 and up

Editions: All

What Is Sales Tax Report

- Sales Reports

- Sales Tax Report - View process transactions and sales tax information.

Making The Connection

Where Will I See This Within OLX?

You can view order information by state using the Sales Tax Report. This is a report that you can create an automated schedule for, in order to deliver the data via email or to an FTP site.

This is a report that gives you the ability to hyperlink to the order detail screen, in order to access further detailed information. Click on the link that is the order id, and it will pull up another window.

What Imports/Exports Relate to Sales Tax Report?

- At this time there are no imports/exports related to the report

Setup

Preview

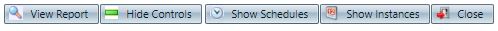

You'll notice control buttons displayed just above the results. Review Report Tools (orderlogix.com) article for more information on how to utilize each control button.  :

:

- View Report

- Displays results

- Displays the toolbar

- Hide Controls

- Hides report filters

- Show Controls

- Displays report filters

- Show Schedules

- Displays schedule editor

- Format filter will display at top of screen

- Delivery and Encryption tabs will display on bottom left of screen

- Show Instances

- Displays list of previously ran and pending reports. Click on the status to review the job log.

- Close

- Close out of the report popup.

Report Definitions

Using Calendar Icon to Set Date(s) is a good article to review when running reports manually or scheduling for automation.

Filters

Filter | Definition |

Date Type |

|

Fiscal Week (only shows during manual run when utilizing User Selected Date Type above) | This will set the below Date Range to the Monday - Sunday date range selected from this drop down. |

Create date of the payment batch the successful payment transaction was in | |

Report Layout | 3-layer filter to display report data (see Grouping below) example if set to Date/Ship State/Order ID: |

Expand |

|

Format (only shows when setting up a schedule) | This is the format that the report will export in:

|

Client of the source of the order | |

Show Inactive (Client) | Show in the report:

|

Campaign of the source of the order | |

Show Inactive (Campaign) | Show in the report:

|

The shipping state of the order |

Grouping/Report Layout

Grouping | Definition |

| Bill State | The state of the master customer record |

Campaign | Campaign of the source of the order |

Client | Client of the source of the order |

Date | The create date of the payment batch |

Ship State | The shipping state of the order |

Order ID | Order ID of the order |

Column Definitions

Column | Definition |

Order ID | Order ID |

Transaction Date | Payment batch create date |

Transaction Type | DEBIT or CREDIT |

Amt Collected | Quantity * Unit Price + Shipping + Tax of the items |

Total | Quantity * Unit Price + Shipping + Tax of the items |

Unit Price | Quantity * Unit Price of the items |

Shipping | Shipping of the items |

Tax | Tax of the items |

Bill State | The state of the master customer record |

Bill County | The county of the master customer record |

Bill City | The city of the master customer record |

Bill Zip | The postal code of the master customer record |

Ship State | The shipping state of the order |

Ship County | The shipping county of the order |

Ship City | The shipping city of the order |

Ship Zip | The shipping postal code of the order |

Client | Client of the source of the order |

Grand Totals | Sum of column(s) |

Copyright 2019

Revised 1.27.2026

Revised 1.27.2026

Related Articles

Sales Tax by State Report Definitions

Module: Reports Path: Reports > Sales Reports > Sales Tax by State Report Topic: Sales Tax by State Report Version(s): 5.1 and up Editions: All What Is Sales Tax by State Report Sales Reports Sales Tax By State/Order Report - This drill-down report ...Gross Sales Report Definitions

Module: Reports Path: Reports > Sales Reports > Gross Sales Report Topic: Gross Sales Report Version(s): 5.1 and up Editions: All What Is Gross Sales Report Sales Reports Gross Sales Report - Sales By Client/Product Group/Product Code. Making The ...Sales Agent Commission Summary Report Definitions

This report is run by commission batches that are created and breaks out the commission batch by team and employee. Sales Agent Commission Summary Report Column Definitions Team Team Name Emp. # Employee Number Employee Employee Name (Last, First) # ...Return Analysis Report Definitions

Module: Reports Path: Reports > Processing Reports > Return Analysis Report Topic: Returns Analysis Report Version(s): 5.1 and up Editions: All What Is Return Analysis Report Processing Reports Return Analysis - Analyze the return rate for previous ...Returns Report Definitions

Module: Reports Path: Reports > Processing Reports > Returns Report Topic: Returns Report Version(s): 5.1 and up Editions: All What Is Returns Report Returns Report displays the returns for auto-generated (continuity/subscription) and ...